Looking to invest in a rental property with impressive returns?

Searching for that perfect balance between affordability and growth potential?

Look no further than the suburbs of Brisbane, the vibrant and booming capital city of Queensland, Australia.

In the quest to find the best rental yield, Brisbane stands tall as an alluring destination for property investors. With its thriving real estate market, a diverse range of suburbs, and a wealth of opportunities, this city has something for everyone.

We'll dive into the depths of Brisbane's rental market, exploring high-yield areas, near-city apartment suburbs, major infrastructure projects, and local real estate's emerging trends that are shaping the market.

Whether you're a seasoned property investor or dipping your toes into the world of real estate for the first time, this article will guide you towards the hottest rental prospects in Brisbane in 2024.

Understanding rental yield in Brisbane

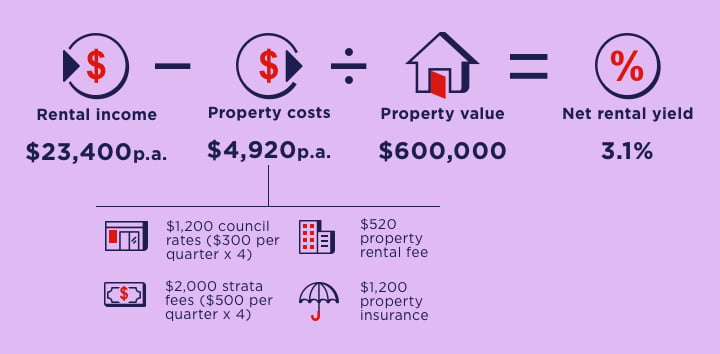

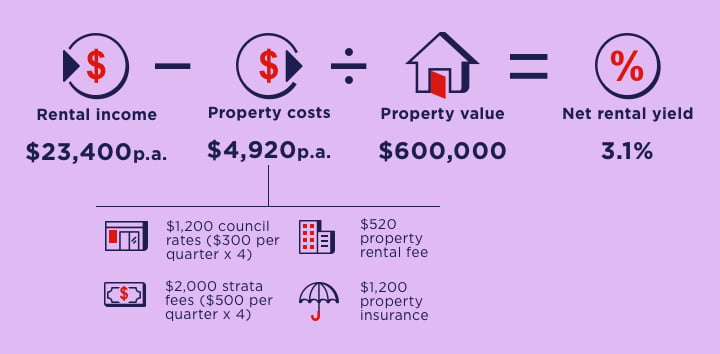

Rental yield is a crucial metric for property investors. It provides a clear picture of the income generated by an investment property in relation to its value. This makes it a key factor to consider when seeking the best returns on your investment.

Rental yield is typically expressed as a percentage, calculated by dividing the annual rental income by the property's value or purchase price, multiplied by 100.

In Brisbane, rental yield can vary across different suburbs and property types. Generally, higher rental yields are found in suburbs where property prices are more affordable relative to the rental income they generate.

Analysing rental yield, alongside other factors such as vacancy rates, market trends, and growth prospects, will empower you to identify the best opportunities that align with your investment strategy and financial goals.

Why rental yield is an important indicator of investment profitability

Rental yield serves as a critical indicator of investment profitability in the real estate market, making it vital for successful property investment. It provides valuable insights into the potential returns an investment property can generate.

A high rental yield signifies that the property is generating a substantial rental income in relation to its value, which can result in positive cash flow and overall profitability.

For investors seeking regular streams of income, high rental yields ensure a steady flow of rental payments, which can help cover mortgage repayments, maintenance costs, and other expenses.

Rental yield also aids in assessing the performance and competitiveness of different rental opportunities. By comparing rental yields across various suburbs or property types, investors can identify areas with higher rental demand, better rental growth prospects, and the potential for long-term capital appreciation.

Factors that affect rental yield in Brisbane

- Location: The suburb and location of the investment property play a significant role in determining rental yield. Suburbs with high demand, proximity to amenities, public transportation, schools, and major employment hubs tend to attract tenants much more easily, leading to higher yields.

- Property type: Different property types, such as houses, units, or townhouses, can yield varying rental returns. The size, condition, and features of the property, along with its suitability for the target rental market, can impact the rental yield. Understanding the preferences and needs of tenants in the Brisbane market is crucial when selecting your investment property.

- Market conditions: Rental yield is influenced by the overall real estate market conditions in Brisbane. Factors such as supply and demand dynamics, vacancy rates, population growth, and economic indicators can impact rental prices and subsequently affect the yield. Monitoring the market trends and staying updated on the local property landscape is essential.

- Property management: Efficient property management can contribute to maximising the rental yield. Engaging a professional property manager who can effectively market the property, screen tenants, and handle maintenance and rental collection can help optimise rental income and minimise vacancies, enhancing your yield.

- Rental market competition: The level of competition in the rental market can affect rental yields. A higher number of available rental properties in a particular area can put downward pressure on rental prices, potentially impacting the yield. Understanding your competition and the supply–demand dynamics in your chosen Brisbane suburb is essential.

By carefully considering these elements and conducting thorough research, you can identify areas and properties that offer optimal rental yields that align with your investment goals.

8 tips to finding high rental yield suburbs in Brisbane

Finding high rental yield suburbs in Brisbane is a goal for many property investors seeking lucrative returns on their investments. The right location can make all the difference when it comes to rental income and overall profitability.

Here are eight valuable tips to help you uncover the hidden gems and identify the suburbs in Brisbane that offer the potential for impressive yields in 2024 and beyond.

Tip #1 - Research median rental yields

One valuable tip is to research the median price and rental yields of your chosen suburb. By delving into this data, along with the median property price, you can gain insights into the potential returns on your investment.

Look for suburbs with higher median rental yields. They often indicate a stronger rental market and the potential for more lucrative rental income.

Having this information up your sleeve allows you to focus your attention on areas that have historically shown promising rental yields, setting you on the path to finding a profitable investment property.

Tip #2 - Analyse rental price trends

Another helpful tip is to analyse historical rental price trends. By examining rental price data over a period of time, you can gain valuable insights into the rental market's performance.

Look for suburbs where rental prices have shown consistency or upward growth, as this indicates a healthy demand for rental properties and the potential for higher yields.

Understanding historical rental prices and trends allows you to make informed decisions and invest in areas that have demonstrated stability and growth, setting you up for a successful investment.

Tip #3 - Consider proximity to employment hubs

It's important to consider the proximity of the area to employment hubs. Suburbs located near major employment centres, such as the Brisbane CBD, or growing industries tend to attract strong demand for rental properties.

People, particularly renters, often prefer to live close to their workplace when possible. This minimises their commute time and allows them to enjoy the convenience of nearby amenities.

By focusing on suburbs in proximity to these employment hubs, you can increase your likelihood of finding tenants.

Tip #4 - Evaluate infrastructure development

Considering the infrastructure development in a suburb is valuable when searching for high yields. Keep an eye out for areas experiencing significant infrastructure projects, such as transportation upgrades, new commercial developments, or educational institutions.

These developments can attract more residents and businesses to the area, resulting in an increased demand for rental properties.

By investing in suburbs with active infrastructure development, you'll be positioning yourself to benefit from the rising demand and capitalise on higher yields as the area grows.

Tip #5 - Study vacancy rates

Studying vacancy rates is valuable when searching for high rental yield suburbs. Vacancy rates indicate the proportion of rental properties that are currently unoccupied or available for rent in a specific area.

Low vacancy rates suggest a strong rental market with a high demand, which can lead to higher rental yields.

By focusing on suburbs with low vacancy rates, you can increase the chances of finding tenants quickly and maintaining a consistent rental income.

Tip #6 - Explore growth suburbs

Exploring the city's growth suburbs is key when seeking high rental yields. Growth suburbs are areas experiencing positive population growth, infrastructure development, and increasing property values.

Investing in these suburbs can offer the potential for long-term rental yield growth. By identifying growth suburbs, you position yourself to benefit from the rising rental demand, as more people are drawn to these areas for their promising prospects.

Keep an eye on suburbs with a track record of growth and consider their potential for delivering solid rental yields in the future.

Tip #7 - Look for lifestyle locations and amenities

When searching for high rental yield suburbs, it's important to consider the presence of lifestyle amenities in the area.

Look for suburbs that offer attractive amenities, such as parks, schools, shopping centres, dining options, and recreational facilities. These amenities enhance the desirability of the area, making it more appealing to potential tenants.

Suburbs with easy access to lifestyle amenities tend to attract renters looking for convenience and a well-rounded lifestyle, increasing the demand for rental properties and potentially leading to higher yields for your investment.

Tip #8 - Consult with local real estate professionals

Consulting with local real estate professionals is also incredibly valuable. These professionals possess in-depth knowledge of the local market, trends, and suburbs.

By seeking their expertise, you can gain valuable insights and guidance on the best areas for investment, rental yield potential, and emerging opportunities.

Local real estate professionals can provide valuable advice, help you navigate the market with confidence, and assist in identifying suburbs in Brisbane that align with your investment goals.

Is it worth investing in a Brisbane rental property in 2024?

Investing in a Brisbane rental property in 2024 can be well worth the effort! Brisbane's real estate market continues to show strength and growth, with a balance of affordability and potential for rental yield, particularly compared to other capital cities across Australia.

The city's diverse suburbs, infrastructure developments, and lifestyle amenities offer opportunities for investors seeking long-term rental income and the potential for capital appreciation. Whether you prefer a northern suburb, want to secure a property in a riverside suburb, or want to look into the Ipswich city market, the right property is out there, waiting for you.

By conducting thorough research, analysing market trends, and considering factors like rental demand and growth prospects, you have the power to make informed decisions and tap into the promising rental market of Brisbane city.

Getting the best rental yield | Brisbane and its investment property opportunities

Brisbane presents a wealth of opportunities for property investors. By following the tips outlined in this article, you can uncover the hidden gems and make informed decisions to generate reliable rental income.

Brisbane's thriving real estate market, alongside its wealth of affordable, well-located apartments and growth potential, makes it a compelling location for anyone seeking profitable rental investments.

Take this article as your sign to seize this opportunity and unlock the rental yield potential in Brisbane. It's time to embark on a rewarding journey in the city's dynamic property market.

Want to maximise your rental yield? Work with the best in Brisbane

If you're interested in seriously exploring Brisbane's rental market and seizing this opportunity, now is the time to take action.

Connect with Penrose Real Estate, your trusted partner in navigating the vibrant property landscape of Brisbane city. Our team of experienced professionals is ready to assist you in finding the perfect high rental yield property that aligns with your major investment goals.

Don't miss out on the potential for lucrative returns and steady rental income. Contact us today!