There's an old saying that properties are worth what someone is willing to pay for them. However, there are many reasons homes sell for more or less than they are worth.

As a seller, knowing the true market value of your home will help you achieve a fair sale price. As a home buyer, a professional evaluation of a home ensures you won't pay too much for it, especially as market conditions push home prices sky-high. However, even if you're not about to buy or sell, a professional assessment of a property's value can be helpful.

Let's explore how a valuation differs from an appraisal, how it can help you maximise your sale price and make smarter investment decisions and why, even if you're planning on staying in your home for a long time, a property valuation can be beneficial.

Why Property Valuation Matters: More Than Just a Number

A property valuation is the estimated market value of a property. This differs from the market price, which is what someone is willing to pay for it. A property valuation is conducted by a qualified property valuer who may work independently or for a lender. They need to be registered with the Australian Property Institute as a Certified Practising Valuer.

A property valuation considers factors such as:

- Land size and topography

- The size and condition of the house

- The property's location and how easy it is to access

- Its structure, fittings and fixtures

- Council zoning

- Heritage conditions

- Recent sales of comparable properties in the area

- Current housing market conditions

Read more about property valuers' reports here.

When Might You Need a Professional Valuation?

A professional valuation of a property is helpful in several situations including:

- When buying a property using a bank or lender to help you fund the purchase, they may request a valuation to determine how much they will lend you.

- If you're a home buyer, a professional valuation can ensure that you're not overpaying.

- If you're selling your home, a valuation can help set a fair asking price (see below for more on the difference between a valuation and an appraisal).

- If you're going to put a home up for rent, it can help you assess its rental value.

- Before a renovation or improvements, valuation can help determine the return on investment and prevent you from overcapitalising.

- If you're refinancing your home loan, your lender will want a valuation to determine the equity in your home.

- For a formal determination of a property's value. For example, in the case of a deceased estate or before making a will.

What's the difference between property appraisals and valuations?

While the two processes for determining the value of a home are similar, a property appraisal is a more informal assessment. An appraisal is conducted by a real estate agent, who will weigh up recent sales data in the area, the condition and features of a home and give you a guide to its market worth.

Because property appraisals are conducted by real estate experts with good knowledge of the local area, they are no less accurate, but they don't have the legal standing of a professional valuation.

Maximising Selling Potential and Gaining Negotiating Power

When setting pricing for the sale of a home, emotion shouldn't come into the decision. However, if you've lived somewhere for many years, it's hard not to become emotionally attached to its worth. A valuation report takes the emotion out of the decision of a fair price because it's conducted by professionals who have no interest in the outcome of the sale.

A professional valuation report can help speed up real estate transactions and can also serve as a powerful tool come negotiation time. Don't forget that properties often sell for more than the asking price, especially when the market is hot.

Making Smarter Investment and Buying Decisions

Whether you're buying your first home or your third investment property, having a property valued before you buy can help you negotiate the price and ensure you don't pay more than it's worth. It can also give you some insight into how much the bank will lend you.

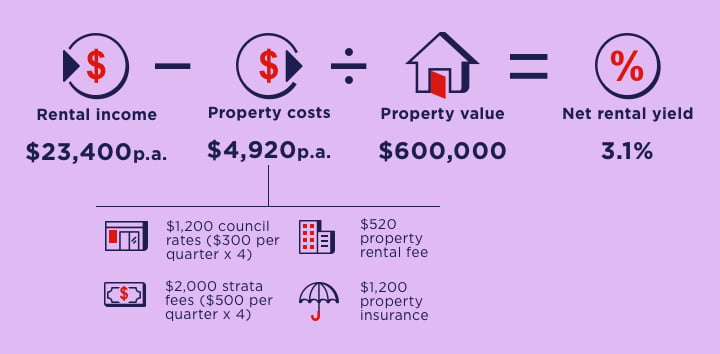

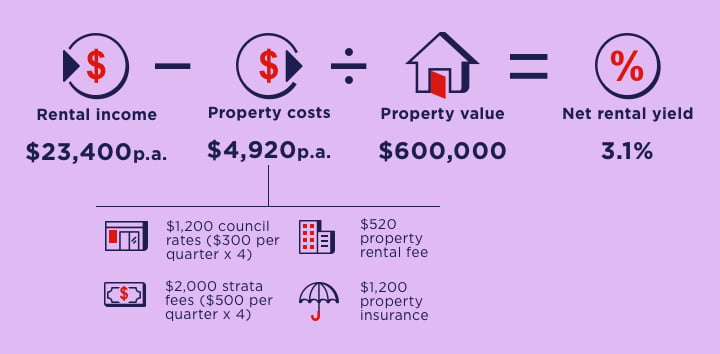

Valuations are also an essential tool for property investors to identify smart investment opportunities and strategise their next moves, as well as determine a property's rental value.

Supporting Mortgage Applications, Refinancing, and Insurance Coverage

When you need to rely on a financial institution to help you fund the purchase of a property, they need to determine how much of a risk the loan poses and if you meet their lending criteria. For this reason, lenders often request property valuations to determine if the loan is a sensible one. It's also used to calculate your loan-to-value ratio and interest rate.

When refinancing, an accurate analysis of the property value helps the bank determine how much equity you've built up in your home.

Having a true understanding of the value of what is most likely to be your most expensive asset also helps ensure the home has the right amount of insurance coverage.

Securing Your Financial Future

When dealing with a deceased estate, a professional assessment of property values during probate is critical to ensuring legal requirements are met, that tax is calculated correctly and that the estate is distributed equitably amongst beneficiaries. For this reason, it's also a good idea to have a property valuation conducted before making a will to give you a better understanding of the worth of your assets and help you distribute your estate.

A professional valuation can also help you manage liability and tax assessments when a market valuation is required by tax law and assist property investors with the ongoing management of assets as it helps to track property performance, assess rental yield and monitor market trends.

Both investors and homeowners should also have a property valuation conducted before and after major renovations. This will help make decisions about rental income, make sure spending aligns with increased capital gains tax and understand the return on investment.

Tapping Into Market Trends and Real Estate Insights

Even if you are not looking to buy or sell a home, a valuation gives you valuable insight into the worth of your property. It helps you stay informed about current market trends and use this knowledge to plan for the future.

However, if you are looking to downsize, change suburbs, purchase an investment home or get into the property market for the first time, the true value of a property is important knowledge to be armed with. The first place to start when assessing the value of your home is with a free property appraisal with a reputable local real estate agent.

Penrose Real Estate has made it easier to start thinking about the value of your home (or one you're looking at buying) with our free online property report which features information about each Brisbane suburb as well as comprehensive sales data. Take a look and when you decide to take the next step, reach out to us, the highly experienced and trustworthy team at Penrose Real Estate.